The March of folly

This is our first post on substack (we will keep it short this time), however, we have been publishing in our LinkedIn page for a while, we encourage readers to read some of our previous posts there.

As a brief introduction Thriddio runs a long-biased global macro strategy pairing top-down strategic and tactical asset allocation with bottom-up selection. Our mandate is relative value to the ACWI albeit, we often deviate significantly from the benchmark.

We publish these notes for informative purposes only, this should NOT be taken as investment advice, and is not a solicitation to subscribe or redeem.

With that out of the way, onto markets:

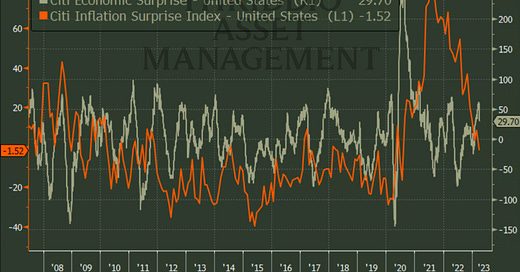

We do not expect anything unusual for tomorrow’s CPI, we guess we would be on the lower end of consensus but not much lower. This in line with both leading indicators and the downward trend in inflation surprises which has been coming down for a bit as shown by Citi’s indicator:

With central bankers still showing hawkishness despite the clear signals from the yield curves across the globe, we have been picking up a bit of duration mostly in the front end but also long end, our latest addition comes in the form of EM long end rates, while we could have gotten a better entry point we had been wanting to dip our toes there for a while and finally decided to pull the trigger (for the record we bought just 1/3rd of our desired size and will add during pullbacks):

We chose MXN nominals given the strength we have seen in currency, equities, and relative macroeconomic “health”, indeed, and as we have mentioned before, we would expect euro and yen outright to converge with mxn rather than the other way around in the following chart: (we use 10yr outright)

We are also a bit concerned by how quickly the 6m-18m spread has moved back down after the upward move in March, we keep an eye on it and think a rally in 2yr treasuries would mean a continued steepening for this particular spread:

We see the latest NFIB print is doing the rounds, our only comment on it is that, unlike previous times when credit availability has contracted, this time is also the actual M2 contracting, this is the first time that has happened on the record:

Finally, other than the duration mentioned above, our portfolio has had no changes we maintain a fairly defensive positioning and we remain equity sellers at 4200 on the SPX.

This is for informational purposes only, it should not be considered as investment advice and does not constitute any offer or solicitation to subscribe or redeem. Investment involves risk. Please consult a licensed investment professional before taking investment decisions.

All charts and graphs copyright © Bloomberg Finance L.P.