Antithesis amalgam

We’d like to begin this one with a follow up of the short position in China we mentioned on our last note, whilst at first it played slightly against us we took the risk budget to the limit and ended up selling for a very nice profit at just about 4USD on the YANG 0.00%↑ . Turned out that shorting a 5 sigma move was indeed quite sensible.

The other trades however didn’t go so well, as URA 0.00%↑ kept on rallying all the way up to 33, we like it as a structural long very much and await to get back in hopefully at 28 but 30 is good enough to rebuild the position. Also the miners we sold finally outperformed gold, so that one played against us as well. (one cannot win them all).

While we prefer the exposure directly through gold, we suggest to keep a close eye on the miners for the sector can trade considerably higher relative to gold as we can see in the following chart:

Duration exposure has been a drag on the portfolio this month. The latest print in Kansas City prices received was a bit surprising as it bounced all the way from. -5 to 11. This could translate to upward pressure in the CPI further down the road so it is important to keep track of it.

We don’t see a strong bounce in inflation at the moment and hold our duration exposure unchanged. However, we find concerning the latest move in breakevens.

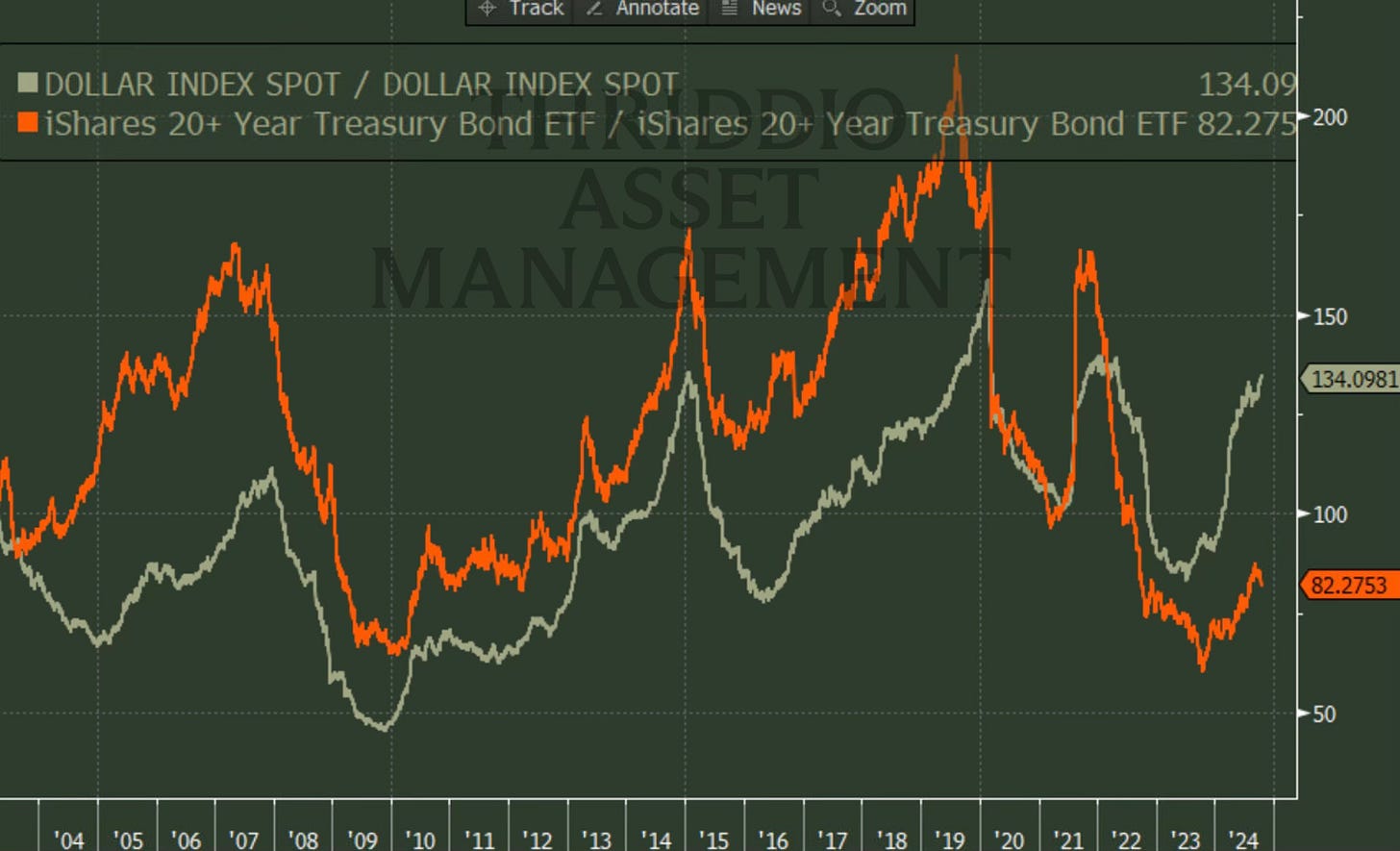

Finally we’d like to briefly comment on the most recent move higher in the USD, we think it has room to go to 105 and change, say 105.30sh before coming back down. We’d expect this spread to narrow as a macro trade: following chart is DXY and TLT, both adjusted for realised volatility, normalised base 100.

Overall we have had a good run almost nonstop since July and we we are diminishing net exposure in a considerble manner; we are bagging in our profits. Also with the US election being so close we prefer to keep a defensive positioning.

The portfolio ranks almost 90th percentile in the peer group YTD and the risk/reward for taking on more risk is not attractive at the moment. We are however, targeting quick trades in FAZ 0.00%↑ and DUST 0.00%↑, the former as an outright directional bet, the latter as a hedge to our structural gold holdings, we think a pullback in gold is in order.

This is for informational purposes only, it should not be considered as investment advice and does not constitute any offer or solicitation to subscribe or redeem. Investment involves risk. Please consult a licensed investment professional before taking investment decisions.

All charts and graphs copyright © Bloomberg Finance L.P.